Analysis: How family offices are investing into VC

Family office survey report 2021 in partnership with First Republic Bank

This post was co-authored by Oper8r and First Republic Bank. In particular, thank you to my co-authors Sam Heshmati and Hana Yang, as well as Caroline Hale and Jaraf Gueye! Oper8r empowers the next generation of great VC fund managers. First Republic Bank has been serving the venture capital and startup ecosystem since its founding in 1985.

Tell us about yourself and how we can help:

Emerging VCs go here (the Oper8r application)

Friends of VCs (LPs, mentors, experts, partners) go here

TLDR

Oper8r and First Republic conducted a survey of family offices in 2021

Family offices as a group remain active as LPs into VC funds, including emerging VC funds; allocation to VC doubled year-over-year relative to last year’s survey

20% of family offices invest exclusively in emerging managers, and 75% of family offices would invest into a first-time fund

Family offices are active co-investors, but potentially are understaffed for this strategy

More family offices seem to be moving into VC, including international family offices

Positive trend of family offices investing in emerging VCs continues

Family offices play a large role as Limited Partners (LPs) in emerging venture capital (VC) funds and also as co-investors in direct investments alongside venture capital funds.

At the beginning of 2021, First Republic Bank and Oper8r surveyed family offices across the U.S. and globally to get a better understanding of their investment strategies, primarily how they invest in VC funds and make co-investments.

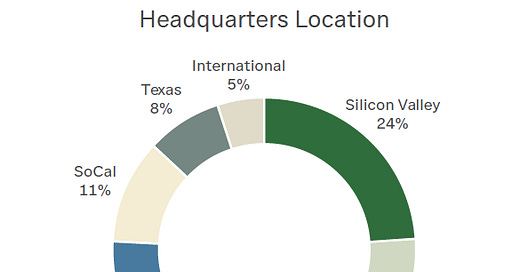

We surveyed a mix of U.S. and international family offices…

About 95% of the participants in the survey are U.S.-based family offices ranging from $15M in assets under management (AUM) to $2.5B AUM with a median size of $200M AUM.

…And noticed that family office allocation to VC more than doubled year over year.

Compared to the 2020 family office survey, venture capital allocation from family offices into emerging VCs remains strong, and the outlook remains bullish heading into 2021. In fact, the average family office investment allocation into VC was 10% in 2020, and this year, that has increased to 24%. This increase in interest may be corroborated by another recent survey by Eaton Partners, which indicates that LPs internationally are finding alternatives more attractive.

20% of family offices exclusively invest in emerging VCs (versus a mix of established and emerging).

Given the survey outreach to family offices that have historically expressed interest in VC investing, there may be sample bias, but it’s interesting to see that 100% of the family offices surveyed invest in emerging VCs, and 20% invest exclusively in emerging VCs. This may be an indication that new family office entrants into VC may begin by accessing emerging managers versus traditional, brand-name funds.

Risk appetite is high given that 75% of family office LPs would invest in a first-time fund.

Risk appetite also appears to have increased. In addition to the interest in investing in emerging VCs (defined as Funds 1–3), three out of four family offices indicated they would be interested in investing in a first-time fund.

According to survey responses, the main reasons behind this push into emerging VCs and first-time funds include:

Lack of access to brand-name funds,

Established funds getting larger, which may create a need to fill the early-stage risk/return profile that was once filled by these established funds, and

The ability to deploy more capital through co-investments alongside emerging managers.

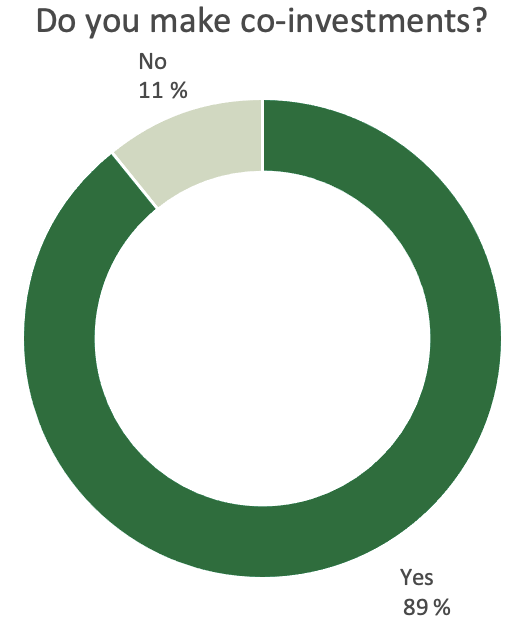

Family offices are very active co-investors, with nine out of 10 LPs making co-investments…

Specifically, the family offices surveyed are very active co-investors, with about 90% of family offices making co-investments, and the most active family offices making 20 investments per year.

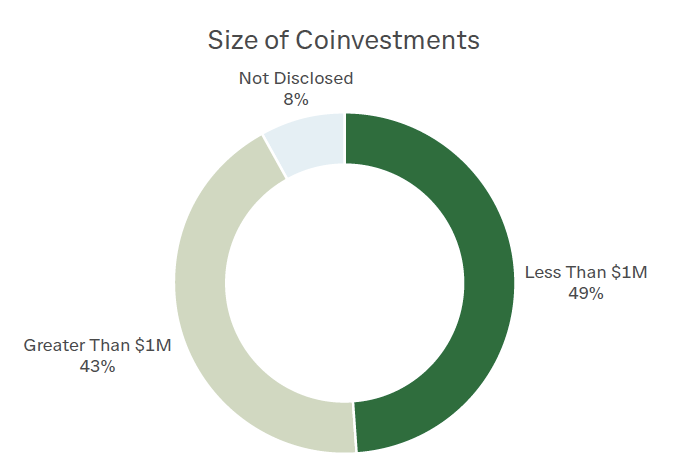

…But only one out of every four family offices employs a dedicated co-investment professional.

It’s also interesting to note that over 40% of family offices write checks greater than $1M at a time into co-investments.

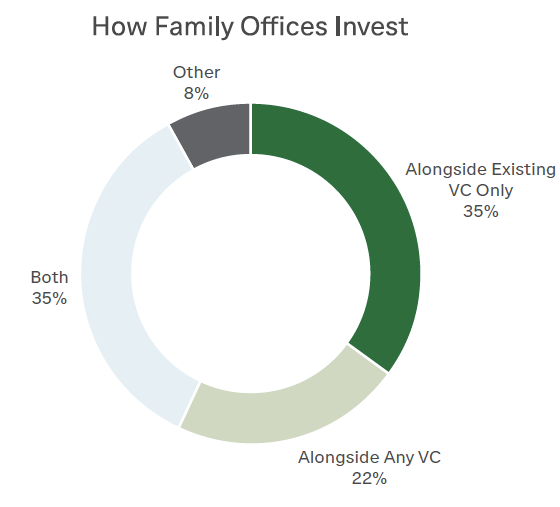

Family offices seem to rely heavily on VCs for diligence given high co-investment activity with minimal staffing.

To make up for minimal investment staff, however, family offices seem to collaborate closely with emerging VCs, with over 90% of respondents investing alongside VCs.

We see an uptick in international family offices investing in emerging managers.

The results show a year-over-year increase in international family office investing in emerging managers. As the world opens up and innovation hubs are created across the globe, it’s not surprising to see more family offices participating in the venture industry. This benefits the underlying innovation ecosystem because the family offices that have been investing in venture in the past are now doubling down by investing in the local funds and/or the underlying portfolio companies.

The survey results are insightful, indicating that family offices remain a strong source of capital for the venture capital ecosystem and, in particular, for emerging VCs. While market data and headlines suggest emerging managers struggled with fundraising in 2020 during the pandemic, family offices in 2021 remain bullish on the fund and co-investment prospects that some emerging managers offer. While there are encouraging signs that family offices are more active, it appears also true from the survey results that family offices are leaning on early-stage VCs for sourcing and information.

The content of this publication is for information purposes only and should not be considered as a commitment to lend or as legal, financial, accounting or tax advice. First Republic Bank and Oper8r make no representations, warranties or other guarantees of any kind as to the accuracy, completeness or timeliness of the information provided in this publication. You should consult with your own professional advisors to fully understand and evaluate the information provided in this publication before making any decision that could affect the legal or financial health of your business.