Sharing Your Track Record as an Emerging VC

Standardize Your Track Record with a Schedule of Investments and Understand What’s Useful for LP Decision-making

This post was co-authored by Oper8r and Carta (thank you @jstraus). Oper8r empowers the next generation of great VC fund managers. Carta helps new VCs build enduring venture capital franchises. Carta and Oper8r are collaborating to build resources to support new venture fund managers. For our first collaborative resource, we are focusing on the investment track record.

Tell us about yourself and how we can help:

TLDR

Track records are a key part of any LP’s due diligence process; and many times they are required for LPs to invest into your VC fund. How to share your track record with an LP can be learned, which is important because LPs may pass quickly on your fund if you don’t clearly present important pieces of information in your track record.

Using a schedule of investments (SoI) to share your track record can show LPs what portfolio you have built to date and how those companies are performing, which may move fundraising conversations forward.

We are providing an overview of a schedule of investments template that VCs can use as a framework for sharing portfolio information with LPs. The schedule has a simple version and a more complex version, which we call the expanded version.

While a schedule of investments can get even more complex than the expanded version, we seek to provide and describe a framework for how to think about expanding the schedule of investments on your own, because you can never fully predict everything an LP will ask. To this end, we describe how LPs evaluate the schedule of investments and why the information you are sharing is important for the LP’s decision-making process.

Lastly, we touch on developing a narrative for your track record. There are a few aspects of the track record we will not address. In a next post, we will address an expanded track record to discuss attribution, board governance, and other important aspects of sharing your track record.

LPs care about your investment experience aka track record

It’s no surprise that LPs care about your track record (see #3!). However, it’s not always obvious what LPs actually want to see. Or how much information you should be sharing. Or how LPs are evaluating your investment experience.

In this article, we walk through a schedule of investments, which is a spreadsheet to share your investment track record with LPs. Typically, the schedule of investments will be a spreadsheet displayed in your dataroom.

A good schedule of investments clearly shows what you invested in, and is an essential part of your track record

A schedule of investments (SoI) is a financial statement in the form of a spreadsheet used by a VC (you!) as a marketing document in the fundraising process. The SoI shows data associated with your investments, usually on a single page. So we’re clear on definitions, a track record on the other hand is the full picture of your professional experiences, investments, reputation, references and network. The SoI is a critical aspect of your track record.

To get to an investment decision, an LP needs to evaluate your track record. The LP wants to see all of your investments in one place. If you put an LP in the position of spending extra time to track down your various investments, there’s a good chance you’ll never convert that LP into an investor in your fund, or even get a first meeting! This is why a schedule of investments is a useful tool in the fundraising process.

Two versions of the schedule of investments

We will walk through two versions of the schedule of investments. The first is a simple SoI, intended to communicate an overview of your investment portfolio. The second version is the expanded SoI which provides your prospective limited partners with a deeper view of your investment history.

The simple schedule of investments

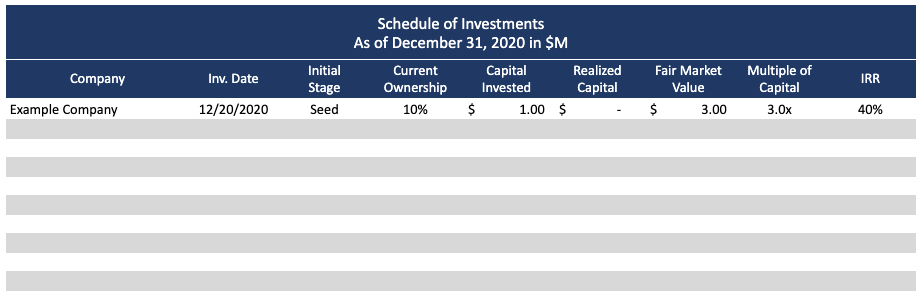

A good schedule of investments is formatted to clearly present what you invested in, such as the name of the company, when you initially invested, and other characteristics about your investments, in particular, the performance. The table below is a template of a schedule of investments that can be shared with LPs.

A simple schedule of investments; Source: Oper8r, LLC

What should be included in a simple schedule of investments?

The following are definitions and related thoughts around disclosing information on your portfolio companies:

Company: the name of the company you invested in (include corporate name, DBA, and also former names if necessary -- early-stage startups can rebrand which may confuse LPs who are following your portfolio progress.)

Investment Date: the date of your initial investment into the company

Initial Stage of Investment: the initial stage (or series) of your investment

Current Ownership: how much of the company do you own, which if the company sells, translates into dollars back to the fund

Capital Invested: how much capital in total you have invested into the company

Realized Capital: how much capital have you realized from your portfolio company (in VC, given you are less likely to have dividends or partial sales like in private equity, this arguably could be removed if you are early in your track record development)

Fair Market Value: this is the value of the invested capital

Multiple of Capital: this is a calculation of Fair Market Value (FMV) divided by the Capital Invested

Internal Rate of Return (IRR): this is also a calculation; while outside of the scope of this article, IRR would be calculated from a related cash flow sheet that tracks invested capital, realizations, and current value of the company

How should you show fund-level returns?

While it is important to show the performance of your individual investments, it is also important to show the performance of your fund by adding up all your investments (outlined in red below). This is especially important if you are an angel investor “rolling” up your track record; this fund-level view will allow an LP to get a full picture of your investment portfolio and gain deeper insight into the types of companies you invest in and your investment strategy.

Adding up your company investments to show fund-level portfolio performance (outlined in red); Source: Oper8r, LLC

The following are definitions and related thoughts around summing up the individual investments in your schedule of investments to show fund-level performance (again, the box outlined in red above):

Capital Invested (Total Fund): this sums up all of your invested capital, and indicates how much money you have “put to work” as an investor

Realized Capital (Total Fund): this sums up how much money you have been able to “get back” from your investments; for early-stage investors, this may be zero if you have not yet sold any companies

Fair Market Value (Total Fund): this sums up the value of all of your investments

Gross performance (Total Fund): the gross Multiple of Capital is a calculation that divides the the Fair Market Value (sum of individual companies) by Capital Invested (sum of individual companies); the gross IRR is a calculation driven by the aggregated cash flows (outflows and inflows) from all of your investments (note: this is a separate worksheet calculation and is not a sum of individual company IRRs)

Net performance (Total Fund): this is also a calculation that shows your performance after subtracting or “netting out” expenses and fees. Some early-stage managers, especially if you are pulling together an angel portfolio, may find it difficult to calculate net performance since they do not yet have fund fees and expenses (if this is the case, you can estimate the net performance based on the fee structure of your next fund and how this fee structure would have affected a portfolio of all your prior investments)

Practically, pulling together a schedule of investments means you as the VC will have to spend time organizing your investments, for example, understanding how much you invested into each company, at what stage, and getting the valuation of your investments. For earlier stage funds, sometimes getting the valuation may be difficult. If you do not have access to all of your companies’ valuation data, make sure to clearly state what are approximations. It is also important to note your valuation methodology, whether your valuations are based on third-party financings or revenue multiples.

If this is your first fund, while the schedule of investments represents a “fund portfolio” this view of your track record is a “synthetic fund” meaning that you probably did not put together these investments thinking about portfolio construction theory. That’s not a problem, and is expected before you raise a dedicated fund.

The expanded schedule of investments

Expand your schedule of investments if it helps LPs better evaluate your investment ability. While we will not dive into every permutation of how you as a VC can expand your simple schedule of investments, the key point is that LPs are trying to understand how good of an investor you are, which includes understanding how good of a “picker” you are, what role you played in making the investment, and building confidence around whether you understand investment management and can repeat the process of finding and making great investments.

Providing an expanded schedule of investments helps LPs determine how strong of an investor you are. For example, the table below is almost exactly the same as the simple schedule of investments above, but it breaks out initial invested capital and follow-on invested capital into two separate columns.

An expanded schedule of investments separating initial and follow-on capital; Source: Oper8r, LLC

Why is this important? This is important because LPs are trying to understand whether you appropriately manage your reserves and invest follow-on capital into your best performing companies. By breaking it out in the expanded version, you may demonstrate to the LP that you are not only a good picker, but maintain discretion over time and have the influence to invest capital into your best performing portfolio companies.

Expand your schedule of investments to provide each LP with what’s specifically important to them

LPs will analyze your track record. Providing them with additional information that helps them conduct this analysis benefits you. For example, below is a snapshot of additional columns you may add. This is not comprehensive by any means, but does provide more information on the individual companies, which gives the LPs more insight into your investment strategy. For example, in this case, the LP may glean you are investing outside of Silicon Valley in financial technology at relatively low entry valuations. By taking this perspective, that is, thinking about what information could move the conversation forward with the LP, this could help you build out the columns in your own schedule of investments that suits your target LP.

An example of additional information in one version of an expanded schedule of investments; Source: Oper8r, LLC

The analysis by the LP on your track record can and will get more complex, especially the longer you have been investing

Given the importance of evaluating a track record, LPs may request even more information about your companies and analyze your track record even further. For example, they may seek information that gives them higher confidence that you are investing in a high-value network, or fitting a particular ESG or DE&I mandate, or understanding how the individual companies are performing from an operating perspective, or determining what types of securities you are holding, e.g. SAFE, preferred equity, etc.

In these cases when you are asked to disclose more information, it is essential to understand why the LP is asking for this information, how it improves your standing in the fundraising process, and whether it is too time-consuming for you to track down that information (without a high chance of conversion).

A framework for sharing your schedule of investments

What’s the right amount of portfolio company information to disclose in an SoI?

In both versions, simple and expanded, your investment data should be treated as sensitive. It is important for a VC to build trust with prospective LPs, and it is also important to maintain trust and preserve your relationship with founders and other stakeholders in the VC ecosystem. For this reason, you should be careful how much and when you disclose information to LPs. Also, you should know whether you have permission to share portfolio company information. You do not want to get in trouble with a founder for disclosing information that may jeopardize the founder’s company in some way. This is a big reason why you may want to start your outreach with LPs with the simple version.

As the relationship progresses between the LP and VC, and you begin to build more trust with the LP, you may choose to share additional information on the underlying companies to give this prospective investor a deeper understanding of the individual portfolio companies and deeper insight into your investment strategy.

When is the best time to share an SoI and how will it be perceived by an LP?

A simple version of a schedule of investments, like the one shown above, can be shared early in the fundraising process. It is meant to show the length and breadth of your investment experience, providing an LP with quick insight into how mature your track record is. For example, if you have been investing since 2007, and have nine companies that are valued over 10x multiples, and two of those are realized, that would be considered a mature track record.

However, on the other hand, if you have been investing since 2019, and have invested in nine companies, but they are all still held at cost, that would be less appealing to LPs who are looking for positive signals from the companies you invested into, such as securing follow-on capital from a top tier VC.

Crafting the narrative of your track record

Whereas the schedule of investments is an important asset in your dataroom, a well-designed narrative can bring your investment portfolio to life. In a future post, we will address other ways to illustrate your track record that makes it easier for LPs to understand the performance of your underlying portfolio companies. In particular, we will discuss how an LP will want to understand your point-of-view on your investment portfolio. After all, they are hiring you to manage their money. They want to know you are the expert and understand your portfolio companies very, very well.

DISCLOSURE: This communication is on behalf of Oper8r, LLC. This communication is not to be construed as legal, financial, accounting or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Oper8r does not assume any liability for reliance on the information provided herein. All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.

great stuff.

i've found that for most early-stage VCs, looking at the overall % of round-to-round progressions on their entire portfolio may sometimes be a more revealing metric than just looking at the top performers (which might just be lucky, or unlucky).

while i agree it's important to show standardized metrics (especially in later years, 5-10), in the first few years what i really care about is what % of your seed deals made it to Series A and B, not so much whether you got lucky and 1 of your deals turned out to be Uber or Coinbase.

if someone shows me an average "hit rate" in their first 4-5 years from seed to Series B that's over 30% (ie, >50% of your seed deals got to Series A, and over 1/2 got from A->B), then i'm paying a lot more attention.

Do you have the template to share? That would be amazing!