Call to action: Apply to Oper8r!

We’re recruiting for the next Oper8r cohort + a snapshot analysis of current applications

Introduction

Oper8r is an 8-week intensive paid course with a dedicated community of VCs and over 150 Tier 1 LPs built to educate and empower the next generation of great fund managers. Backed by Amazon, Carta, FRB, Frank Rimerman, and Docsend, the core curriculum provides exposure to LPs for insights, authentic feedback, and relationship building along with best practices from expert service providers to build the foundation of your firm.

TLDR

We’re seeking applications to Oper8r Cohort II (apply here!)

Application due: March 10, 2021

Next cohort launch: End of March / early April

If you miss the deadline, your application will be considered for Oper8r Cohort III

Apply to Oper8r!

At Oper8r, we believe that emerging VCs outperform.

To give these emerging VCs an edge, we’ve created a “YC for funds” program to help VCs on all facets of venture firm building, including:

Understanding how to build a VC firm, plan for subsequent funds

Fundraising strategy, including understanding the fundraising process

Operational fund management

And much more, including team building, parsing the LP world, and learning the legal and ethical responsibilities of a professional fund manager

In 2020, we launched Cohort I with 18 high potential emerging investors, who participated in 18 core curriculum modules which was highly successful for all involved. We’ve iterated to focus even more on fundraising go-to-market, education, and community. We are thrilled to be launching our next cohort!

Oper8r brings more transparency to early-stage VC

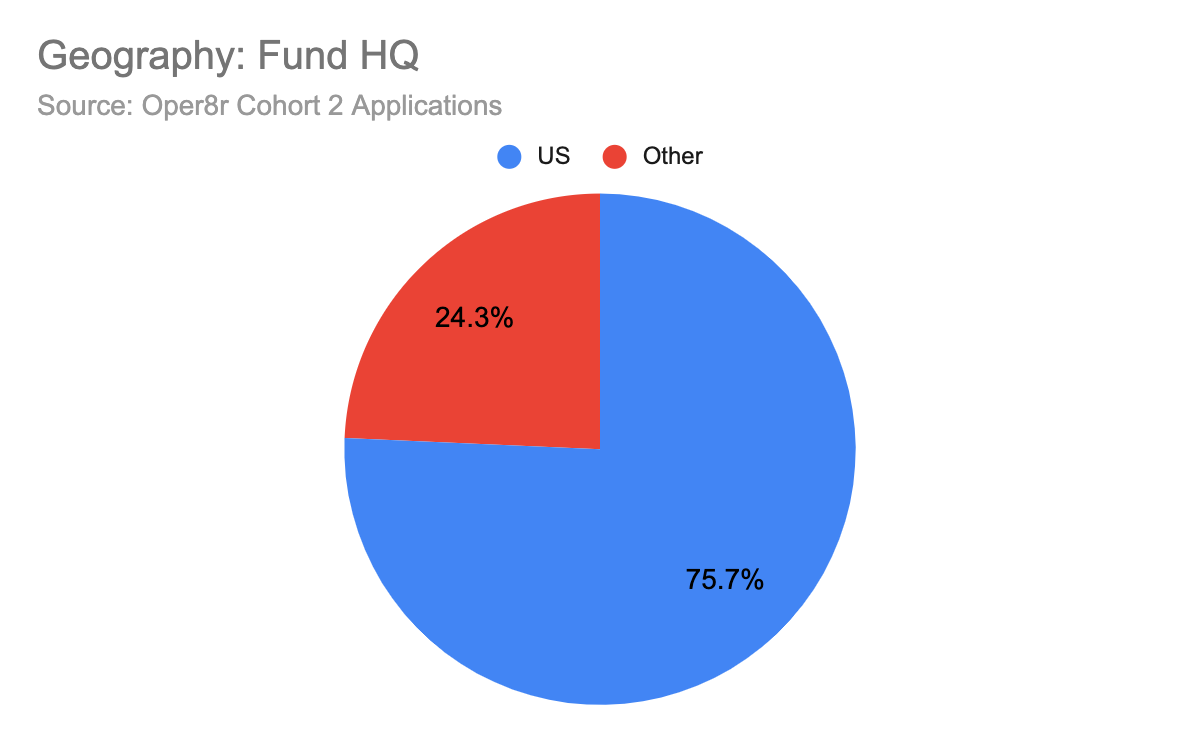

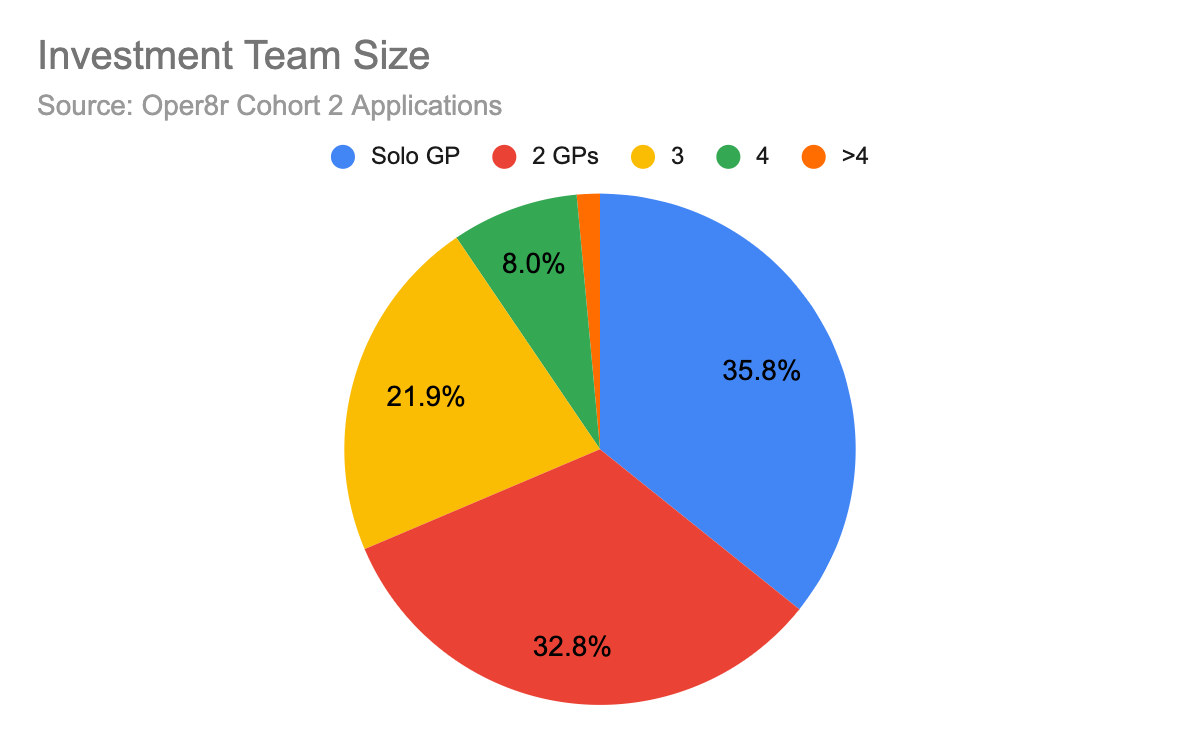

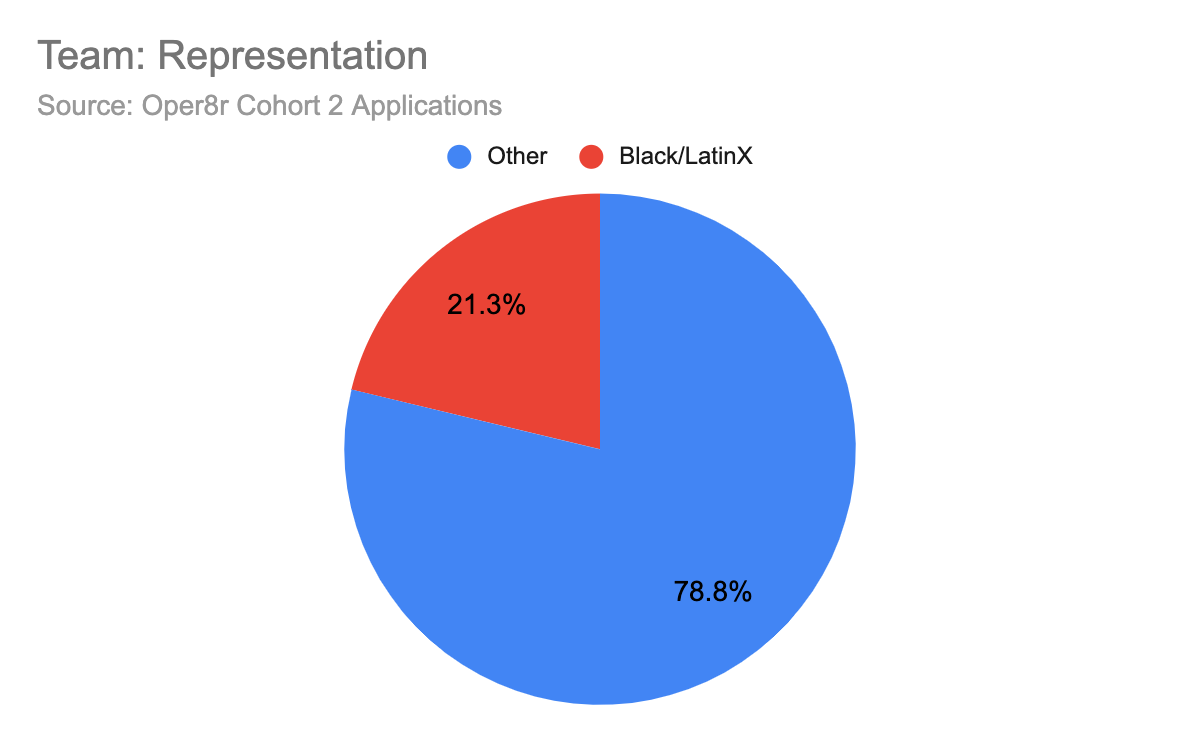

As a first step, we’re aggregating and sharing some of the application data. There is so much untapped potential. Our goal with sharing is to help VCs and LPs understand the size and scope of the early-stage VC market.

A note on data: The analysis below has selection bias given these are applications to Oper8r, but given the larger sample size (over 350 applications so far), it may give a representative view on what a portion of early-stage VC looks like today: