Seeing the present (of emerging micro-VC) clearly

The market forces shaping an emerging micro-VC strategy

Oper8r is focused on enabling the next generation of great founders in VC by empowering the next generation of great emerging micro-VCs that fund them.

Tell us about yourself and how we can help:

Disclaimer: This is not investment advice, and is for informational purposes only!

We talked previously about the importance of emerging micro-VCs to the overall health of the VC ecosystem, but we didn’t talk about the relevance and importance in terms of overall growth, returns, and risk.

So let’s talk about that!

tl;dr:

Private markets are growing quickly - VC in particular - for a variety of reasons, one of which is likely the high potential for outsize returns

Within VC, growth is lopsided. Later-stage VC and larger funds are attracting capital at a faster rate than early-stage VC and smaller funds

Newer and smaller funds tend to outperform older and larger ones, but also present greater risk

(Most) emerging micro-VCs look to LPs a lot like seed-stage startups look to VCs: Small, early, and mostly an idea. Like seed-stage startups, they can present enormous returns, but also come with significant risk.

The data in this article is derived from a longer report we produced earlier this year. If you would like to learn more, please contact us.

Public Markets vs. Private Markets

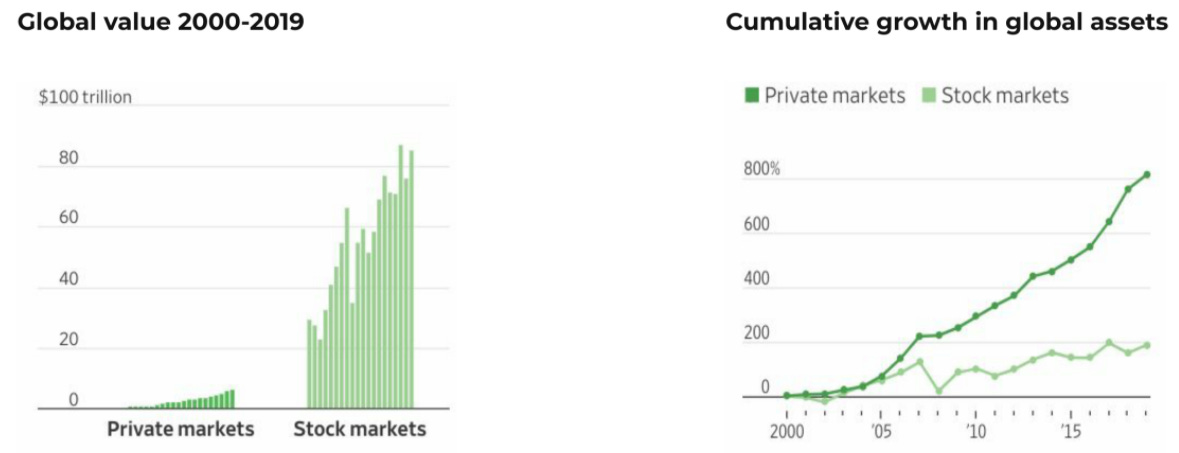

Taking a big step back, it seems clear that financial markets are undergoing a fundamental shift right now, with capital moving into the private markets at an accelerating rate.

A lot of this growth is simply due to the physics of capital markets: Compared to public markets, private markets are teeny-tiny, so simply adding a dollar into one results in a much faster growth-rate than into the other.

So what’s happening?

Yes, the public markets are growing in value, but also experiencing a decline in membership. (Door #3 to the rescue? Definitely a topic for another post.)

Meanwhile, private markets are growing in value, and capital markets have adjusted to keep companies private for longer and longer,

which makes sense when considering the potential for growth in one vs the other.

Private Markets vs. Venture Capital

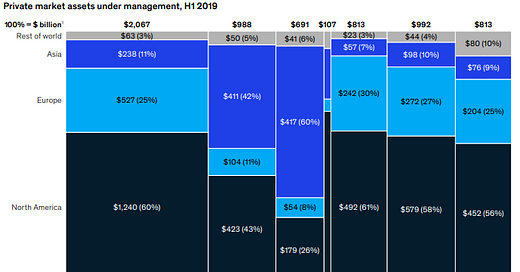

And when you look at the private market, VC stands out as well.

It’s also relatively small;

and performs well relative to top-performing comparable indices in public markets,

and comparable assets in private equity.

As a result, VC has attracted capital at a rapid and consistent rate.

VC Is Getting Bigger

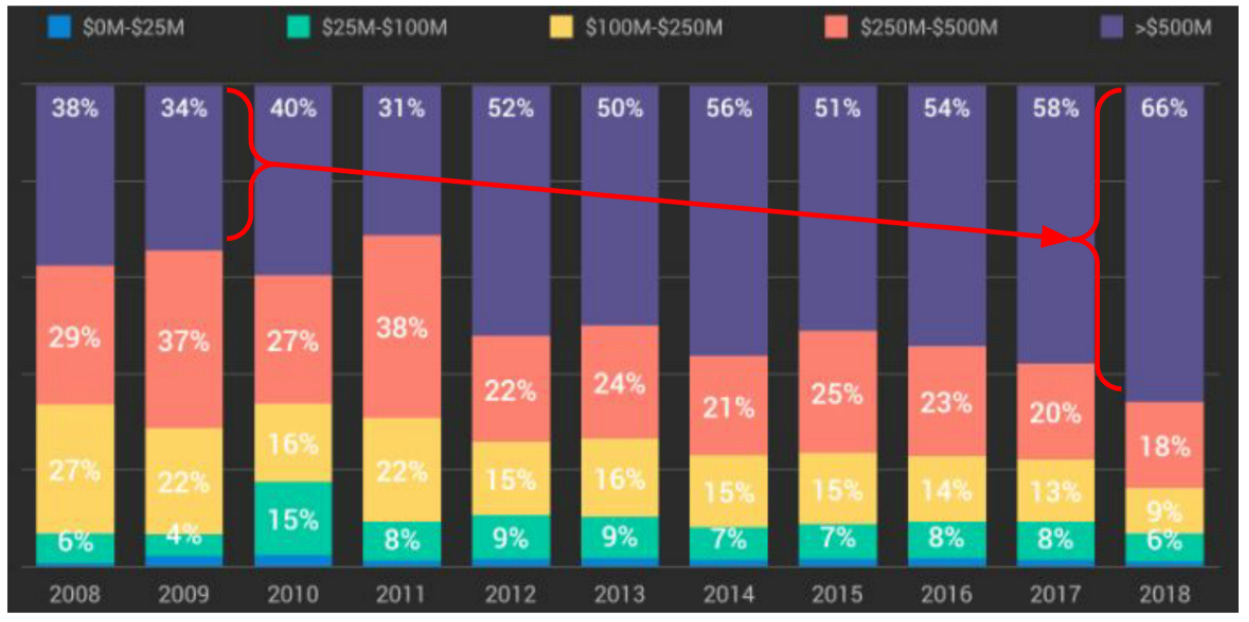

When you unpack the VC market, it’s clear how it’s reacting to the trend of companies getting bigger, older, and less public.

When it comes to VC funds, larger funds are growing at faster rate than smaller ones,

which - due to the physics of capital markets - has made it easier for the funds to write larger checks,

and enable rapidly growing valuations at later stages.

Big VC vs. Little VC

So what about performance?

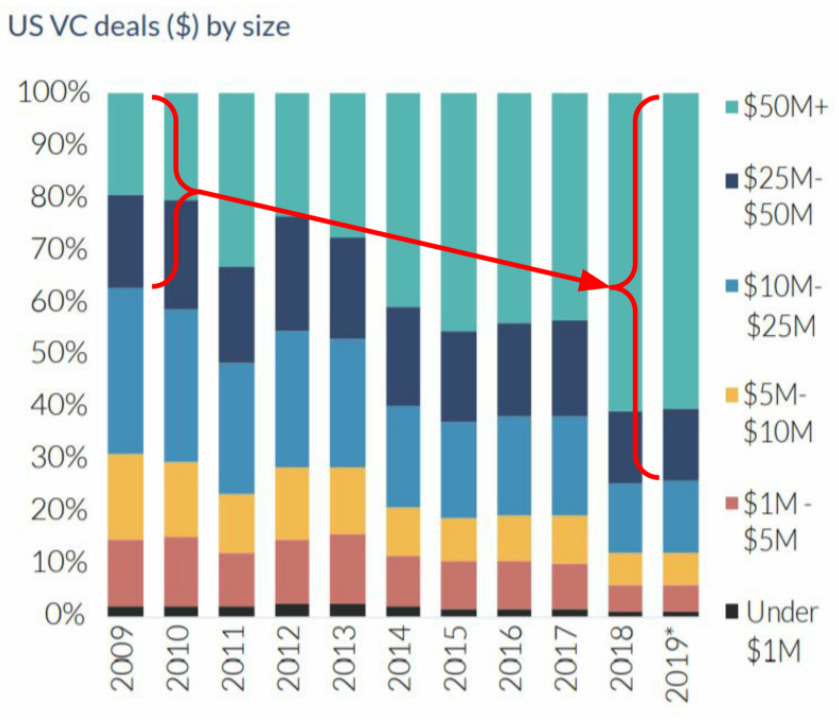

When it comes to return-multiples, the physics of capital says that it’s easier to generate grow a smaller pool at a faster rate. The same seems to be true for VC.

It also helps to be new and early (which also tends to mean small) when you measure by net TVPI,

annual deal value,

and IRR.

However, when it comes to risk, even VC funds are subject to the power-law distributions of the market, where picking winners is very challenging.

Little VC Should Be Bigger

So if emerging micro-VC tends to outperform, then why isn’t growth keeping up with the rest of the market?

We see hurdles on both sides:

The market is fragmented and not set up to scale: By our estimate, there are about 2,000 micro-VCs in - or in the process of entering - the market, but are hard to track. Likewise, LPs that consistently invest in emerging micro-VCs tend to be wealthy individuals and family offices, which have a strong preference for privacy.

VCs lack education: There is no playbook on how to become a VC, so many rely on trial-and-error to establish product/market fit.

LPs aren’t keeping up with the market: Many LPs still believe the best way to access VC is through the established “brands” in venture capital, who have known grown too big for early-stage britches.

In the early 2000s, aspiring CEOs had no where near the access to capital and resources as they do today.

That same change needs to happen for aspiring GPs.