Analysis: The LPs That Invest In Emerging Micro-VCs (Update)

Getting a clearer picture of what “HNWI” actually means

Oper8r is focused on enabling the next generation of great founders in VC by empowering the next generation of great emerging micro-VCs that fund them.

Tell us about yourself and how we can help:

TLDR

Update to a previous analysis

We incorporated 139 new data points, added new classifications, made some updates to the methodology… and made the charts 3D!

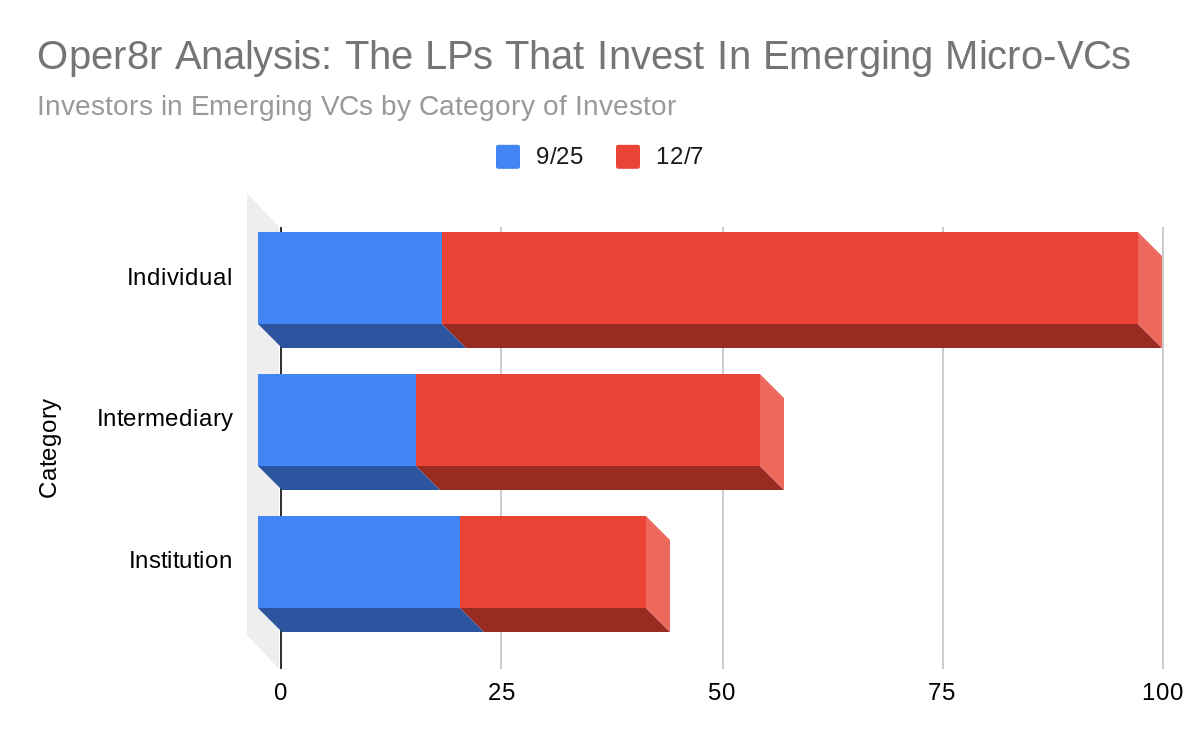

“Individual” is now the #1 category of LP, with “Intermediary” as #2, and “Institution” falling to the back of the pack

The “high net worth individuals” tend to be executives at startups and corporations, and (we still assume) partners at established VC and PE firms

This follows a previous analysis, which drew from 62 LPs. Since then, we have collected information on an additional 139 LPs, so wanted to share what we’re seeing.

Why do this?

Because access to capital is a huge pain-point for emerging micro-VCs. And it’s not for lack of data showing that emerging VCs outperform, but likely due to a lack of transparency (and education) on both sides.

Also because many emerging VCs probably already know that high-net-worth individuals and family offices are much more likely to be LPs than pension funds or sovereign wealth funds.

So we want to do our part by bringing more transparency to the market by consolidating and sharing public and self-reported data.

We made some changes since last time

Increased the total number from 62 to 201 LPs. The 139 additions to the data set continue to come from external submissions and internal research. Unless submissions are self-reported (in which case, we verify the source), all data rely on public sources only.

Added new Type classifications. To better describe the types of LPs we were seeing, we added ‘Executive - Startup’ ‘Executive - Corporation’ ‘Broker-Dealer’ ‘Established PE’ ‘Partner - Established VC’ ‘Partner - Established PE.’

Changed definition of ‘emerging VC’ to increase maximum target AUM from $50M to $150M, and include funds outside the US. Even though this will likely make the data less precise, it will give us a more complete and accurate view of what the market looks like. So far, the overall trends (see below) seem to be consistent with what most emerging VCs and LPs would expect.

The Data: Established VCs Keep The Crown; Wealth Managers Creep Up The List; A Coalition Of Executives And Partners Starts To Take Shape

We broke down LPs by Type and Category, indicating incremental additions since the original analysis.

LPs by Type

LPs by Category

Observations

Judging by Category, it seems that the data set does give an accurate depiction of LPs actually commit into emerging VCs - primarily individuals (FOs and HNWIs), followed by intermediaries (like funds of funds and wealth managers), then institutions (like endowments and foundations).

We’re also starting to get a clearer picture of what the “HNWI” market actually looks like - people who likely generated a significant portion of their wealth from VC (VCs, GPs, startup execs), or from startups that evolve into corporations (PEs, corporate execs).

That seems intuitive to me. Who else would have a greater appreciation of the potential for value creation in the VC industry than the people who actually created and/or captured a meaningful amount of that value?

Whatever the rationale, it’s clear that established VCs (generally speaking, VCs that invest larger and later than emerging micro-VCs) are at the top of the charts.

What the data doesn't tell us is the size and frequency of capital commitments these LPs make - just the number of times their Types appear. So although Institutions are the minority in this context, they are well-positioned to write very large checks. But those checks aren’t especially useful if they exceed the size of your fund, or have a low probability of landing in your fund in any case.

Also important to note that intermediaries have their own LPs, which will likely be a strong indicator of the intermediary’s risk tolerance. For example, a fund of funds representing a group of pension funds seeking stable, uncorrelated returns is probably unlikely to seek a relatively high risk/return profile. On the other end of the spectrum, a private wealth manager representing a group of HNWIs that made their money from VC is perhaps very likely to invest in an emerging VC (then again, some may opt to bypass the managers and just go direct).

The reality is that every LP will have its own set of motivations, but the Type or Category may help you better understand what those motivations are.

What’s Next

We’ll post another update once the data start to tell us something new

Emerging VCs and LPs: Please help the cause of increasing transparency by continuing to contribute to the data, and encouraging your friends to join the conversation and do the same!

Are we overlooking something? Tell us! We’re listening (here, Twitter, and LinkedIn)

Hello, could you please update the link or send the list directly to demetris@stochastic.ventures? Thanks a lot!

oh no! What great material, but the link is not working for me! Any chance you could send it to me? dapapin@wharton.upenn.edu